Radford University

General Information

Pay Checks

Direct Deposit

Direct deposit offers the most secure and convenient method for receiving paychecks. It is mandatory for all Radford University employees, except those on Federal Work Study. With direct deposit, an employee's net pay is electronically transferred directly to their designated checking or savings account(s). Employees can choose to allocate their pay across multiple accounts. Net pay or take-home pay is available for withdrawal on payday through the employee’s financial institution.

Please note: You will receive your paycheck in your bank account on or around the stated pay date on our website. Some banks post paychecks to their customers’ accounts before that pay date. We do not control this and do not guarantee early access to your pay. Please contact us if you do not receive your payment on the actual state pay date.

Employees can now update their Direct Deposit information directly through their Employee Dashboard in OneCampus. For security reasons, please refrain from emailing Direct Deposit forms. Any emailed forms will be deleted and will not be processed.

Paper Checks

Employees who receive paper checks can collect their paychecks from the Office of the University Bursar on payday. A photo ID is required for pickup. Paychecks will only be released to the employee and cannot be given to others.

Stolen, Lost, or Destroyed Check

For stolen, lost, or destroyed paychecks, employees must contact the payroll office regarding replacement.

ACH Returns

Employees who experience ACH returns due to a closed bank account or incorrect account information should contact the payroll office to request a reissue.

Pay Types

The university processes two types of payrolls: one for full-time, salaried employees (semi-monthly) and one for part-time employees (bi-weekly). Full-time employees receive 24 paychecks per calendar year, while part-time employees receive up to 26 paychecks.

Salary Pay

Salary amounts are fixed amounts per pay period often expressed as an annual sum.

Part-Time Pay

Part-time pay includes both hourly wages and fixed, regular amounts paid for work performed over a set period (e.g., adjunct and graduate assistant payments). Hourly wages are variable and are based on the actual hours worked at an established hourly rate.

Electronic Pay Stub

Header:

The header includes university and employee information including the applicable pay period.

Payment Summary:

The payment summary includes the pay date, gross earnings, total personal deductions, and net pay (calculated as gross earnings minus the employee’s deductions). It also details the contributions made by Radford University to benefits programs on the employee's behalf for the pay period.

Earnings:

The Earnings section provides a breakdown of the gross pay for the pay period, including an itemization of regular hours worked, leave time taken, and any stipends received for the employee's position.

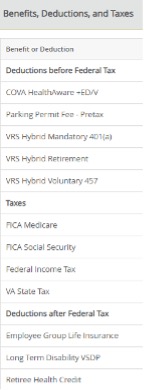

Benefits, Deductions, and Taxes:

This section provides details on employee benefits and deductions, displaying both employee deductions and employer contributions. Deductions from the employee's gross wages are shown in the employee column. The net pay, which is the result of subtracting deductions from gross wages, is deposited into the employee's bank account(s) or issued via check. Benefits and deductions are listed alphabetically and categorized as either pre-tax or post-tax. For more information on specific deductions, refer to the Payroll Deductions tab.

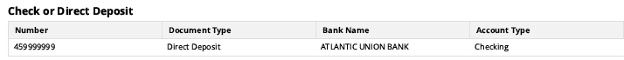

Check or Direct Deposit:

This section provides a breakdown of the employee's net pay, specifying the method of payment (check or direct deposit) and the bank account used.

Printing Employee Pay Stub:

The employee pay stub can be printed directly from the web browser by clicking the 'Printer Friendly' button in the top left corner of the page and selecting the print option.